The biggest Chinese language legislation companies, as ranked by income, weren’t hampered in 2021 by commerce tensions, the federal government’s excessive lockdowns and the shuttering of its borders on account of COVID-19, and even by its personal slowing financial system.

Collectively, the 45 highest-grossing Chinese language legislation companies reported $13.8 billion in gross income in 2021, up a staggering 58% from the pre-pandemic 12 months 2018.

The highest 5 companies haven’t shifted their locations within the income rankings because the final version of China 45 in 2019: Dentons, King & Wooden Mallesons, Yingke, Allbright Regulation Workplaces and Zhong Lun Regulation Agency took prime spots in that order.

The highest 5 companies haven’t shifted their locations within the income rankings because the final version of China 45 in 2019: Dentons, King & Wooden Mallesons, Yingke, Allbright Regulation Workplaces and Zhong Lun Regulation Agency took prime spots in that order.

All 5 companies additionally made the lower for the International 200 report, which ranks international companies based on their gross income. Six different Chinese language companies—DeHeng Regulation Workplaces, Grandall Regulation Agency, Jingsh Regulation Agency, JunHe, Fangda Companions and Tahota Regulation Agency—had been additionally ranked on the International 200. The 11 Chinese language legislation companies on the worldwide chart grossed a collective $9.87 billion.

Dentons, King & Wooden and Yingke had been the one three companies to interrupt the billion-dollar mark, with Dentons grossing $2.94 billion, King & Wooden making $1.43 billion and Yingke closing 2021 with $1.26 billion.

5 of the elite Chinese language practices—Zhong Lun, JunHe, Fangda Companions, Jingtian & Gongcheng, Tian Yuan and Commerce & Finance—grossed greater than $1.95 billion collectively. However the latter three didn’t make the lower for the International 200.

To compile the China 45 rankingswe collect knowledge on gross income and income for the calendar 12 months 2021, in addition to their full-time lawyer equivalents and complete variety of fairness companions.

Of the China 45 companies, Allbright took the limelight by rating fourth, as this mirrored the best progress in gross income in comparison with 2020. In truth, the Shanghai-headquartered follow grossed virtually $300 million—a 40% improve over the prior 12 months. The agency additionally grew its lawyer head rely by roughly 300 in 2021 and had simply over 3,700 legal professionals in complete, together with 355 fairness companions.

At the least within the first half of 2021, AllBright was significantly energetic on US listings work for Chinese language firms. It acted on the preliminary public choices (IPOs) of firms like wealth administration advisor Hywin Holdings, mortgage companies agency Sentage Holdings, Chinese language advertising group Baosheng Media Group, Chinese language e-commerce platform Oriental Tradition and Hangzhou-based activated carbon and biomass power producer CN Vitality, which raised a collective $120 million.

Beijing-based Zhong Lun additionally grew its income—by 25%, which was the equal of or greater than $150 million—having introduced in over $730 million in gross income. DeHeng noticed a bounce of twenty-two% in its gross income, and Grandall’s income topped $620 million in 2021—a rise of 42% over the earlier 12 months.

Zhong Lun’s income will be attributed to a number of of its main restructuring representations, together with for Peking College Founder Group, HNA Group, and PizzaExpress.

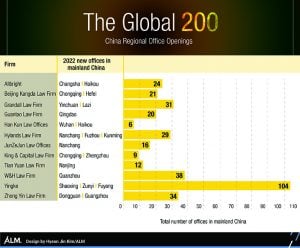

The highest 10 Chinese language companies on the China 45 function vastly completely different enterprise fashions. Dentons, Yingke and Jingsh are identified to prioritize expansive protection. In truth, over the course of 2021, Yingke reported new hires of greater than 2,500 legal professionals globally, marking a 25% improve from the 12 months earlier than. The agency’s complete lawyer head rely as of 2021 stood at 13,299. It has greater than 100 regional workplaces in mainland China and this 12 months opened three further workplaces in Shaoxing, Zunyi and Fuyang.

With that growth, Beijing-based Yingke has aggressively overtaken Dentons because the world’s largest legislation agency. For 2021, Dentons reported 12,064 legal professionals, having added 727 new legal professionals from the 12 months earlier than. Jingsh’s progress of about 11% introduced the agency to five,187 legal professionals in 2021.

RPL, Internet Income and PEP

Dentons, King & Wooden and Allbright took the highest three spots for web income. Dentons netted roughly $794 million whereas King & Wooden and Allbright took house $352 million and $276 million, respectively. That places Dentons’ revenue per fairness (PEP) associate at round $380,000. King & Wooden’s 689 fairness companions took house $511,000 on common, whereas Allbright’s fairness companions obtained $777,000 in common income.

Zhong Lun, Yingke, Grandall, DeHeng, JunHe, Jincheng Tongda & Neal, and Commerce & Finance additionally made the highest 10 by web income. Elite Chinese language follow, JunHe, had a web income of $150 million, based on the agency’s managing associate, Warren Hua, which meant that the agency’s 165 fairness companions noticed income of about $909,000 every.

Trailing the highest 10 on the China 45 are among the nation’s most distinguished practices. Han Kun Regulation Workplaces, Tian Yuan and Jingtiang & Gongcheng netted $94 million, $93 million and $85 million, respectively. The leaner fashions at these companies, although, imply that their fairness companions reaped heftier income in comparison with their expansive rivals. Han Kun has 90 fairness companions who noticed income of $1 million every on common. Tian Yuan’s 125 fairness companions raked in $744,000, and Jingtian’s 135 fairness companions noticed $627,000 in common income.

Income per lawyer (RPL) and PEP are metrics which are seen very in another way by Chinese language companies when in comparison with their western counterparts.

Yingke reported a web revenue of $226 million, which was 18% of its gross income. Whereas this proportion wasn’t the bottom amongst its friends, the agency’s large head rely factors to a considerably decrease RPL and PEP. The agency’s 773 fairness companions noticed income of about $292,000 every, and its RPL was $95,000. Beijing-based Jingsh, which grossed simply over $383 million in 2021, had an excellent decrease RPL at $73,000.

Lockdown Woes Will Hit

The China 45 companies all reported income progress over 2021, however a fall from grace could also be inevitable for these Chinese language gamers.

Earlier this 12 months, Shanghai went into full lockdown for 2 months when its COVID-19 circumstances surged to greater than 13,000 a day firstly of April.

Shanghai accounts for greater than 3% of China’s GDP, and has accounted for greater than 10% of China’s complete commerce since 2018. China’s month-to-month GDP in 2021 was $1.4 trillion, so Shanghai’s lockdown means the nation stands to lose at the least $29 billion for every week the town was locked down.

Elsewhere in China, the federal government’s pursuit of its zero-COVID technique additionally precipitated different cities, together with Xi’an, Yuzhou and Wuhan, to close down. Consequently, within the first half of 2022, China’s GDP grew simply 2.5% on the 12 months. The nation is due to this fact unlikely to fulfill its annual financial progress goal of 5.5%.

Chinese language companies do have an edge over their international counterparts as they double down domestically, taking part in properly to China’s newest “In China, for China” coverage, which focuses on rising the native market and lowering its reliance on international offers.

Design by Hyeon Jin Kim/ALMDesign by Hyeon Jin Kim/ALM

Simply this 12 months, a number of Chinese language companies have launched new provincial workplaces. AllBright, for instance, opened new areas in Changsha and Haikou. The agency now has 24 regional workplaces in China.

Hylands Regulation Agency additionally opened three new workplaces. Grandall, which employed 1,700 legal professionals in 2021, additionally launched new workplaces within the Tibetan metropolis Lazi and in Yinchuan, the capital of the Ningxia Hui Autonomous Area. In Hong Kong, the agency merged with its native associate F. Zimmern & Co, giving it an official Hong Kong follow referred to as Grandall Zimmern Regulation Agency.

Tahota Regulation Agency and W&H Regulation Agency additionally expanded, with the previous setting foot in Quanzhou and the latter partnering with Hong Kong agency Ho Franki & Associates. Han Kun Regulation Workplaces, ZhongYin Regulation Agency, Beijing Kangda Regulation Agency, King & Capital Regulation Agency and JunZeJun Regulation Workplaces all opened new workplaces in provincial China.

For Han Jun, a brand new workplace in Haikou was established to leverage the agency’s functionality and expertise in such areas as asset administration, fund formation and enterprise capital, and personal fairness financing, stated Joyce Li and Xiaoming Li, Han Kun’s co-managing companions. “It was additionally to combine with our present workplaces in Shenzhen and Hong Kong to supply environment friendly and high-quality authorized companies within the Pearl River Delta area,” they stated.

The agency’s new Wuhan workplace can even assist it appeal to expertise with materials sciences, electrical and mechanical engineering levels, as the town is house to many prime universities. Expertise with these capabilities will complement Han Kun’s mental property follow, the agency defined.

In terms of growth, the elite gamers are typically extra conservative. Tian Yuan, which reported virtually $152 million in gross income and $93 million in web revenue, has additionally launched a brand new workplace in Nanjing. The agency now has a dozen workplaces on the mainland.

For the China 45, subsequent 12 months’s monetary reporting will reveal the true influence of China’s zero-Covid pursuit and whether or not their native growth methods are bearing fruit.